The seminar Czech Tax System Guidelines aims to clearly explain the basic principles of the tax system in the Czech Republic from the perspective of a foreign employee, focusing on individual items such as payslip, tax calculation, health and social insurance.

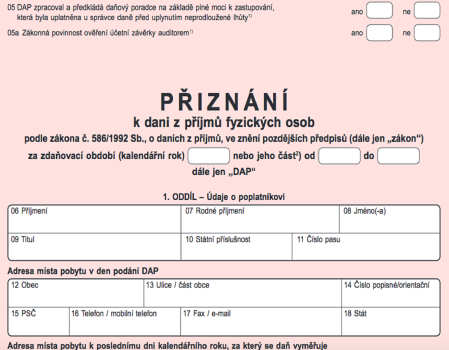

The presentation will also include practical tips and tasks that will teach participants how to read their payslips and to fill in a tax return form correctly if they need to do so. Practical advice and justifications will follow the theoretical part. After the seminar, participants will receive a summary of the information from the presentation.

Points to be discussed:

• General insight into the Czech tax system from the employee's perspective

• Payslip and how to read it; The difference between gross and net wages

• Social and health insurance in the Czech Republic; Who pays for what

• Items reducing the tax base and income tax; Deductions from taxes

• The tax return form and how to fill it in; Who has to fill in the tax return form

• Income tax in the Czech Republic in the context of global income

Schedule of the event: February 22, 2022, from 3 to 6.00 pm.

The event venue: Green Auditorium (no. 141), CU Rectorate, Celetná 20, Prague 1

Lectured by: Iva Barešová

Email contact: swc@cuni.cz

Phone: 224 491 391

Registration: Here

This seminar is funded through the project Operational Programme Research, Development, and Education: Development of the Capacity for Research and Development at Charles University II, project registration number: CZ.02.2.69/0.0/0.0/18_054/0015222

|

Staff Welcome Centre CU Point Charles University Celetná 13 116 36 Prague 1 Czech Republic |

Phone: (+420) 224 491 898 (+420) 224 491 897 E-mail: |